Founded in 1977 by a Filipino immigrant, Josie Natori, today the fashion design brand - NATORI - sells its lingerie, nightwear, loungewear, ready-to-wear, and other high-end women's fashion to upscale department stores in the US, and 15 countries around the world.

CHALLENGE

Big Product Catalog, Small Team

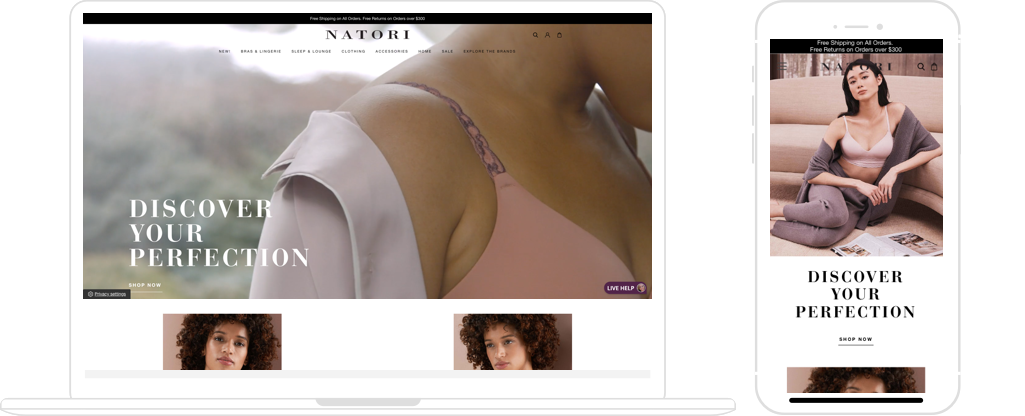

NATORI brand was looking to transition their online store from a proprietary e-commerce platform to BigCommerce and elevate the user experience for the new launch. Natori has a very large product catalog with beautiful apparel and accessories, which is wonderful for their customers, but managing it was challenging when you consider all of the creative assets, photography, and content it takes to make it compelling—especially with their small digital team.

APPROACH

Building Strategic Meaning

Traditionally, NATORI relied on wholesalers to do a lot of their marketing and storytelling, but going direct-to-consumer has enabled them to share their brand story with customers on their own site and in our own way. Moving over to BigCommerce, helped set the brand for success and have a more user-centered digital experience, and increased design capabilities. They will now be able to easily leverage things like video, visual merchandising strategies, and artificial intelligence to engage and convert shoppers.

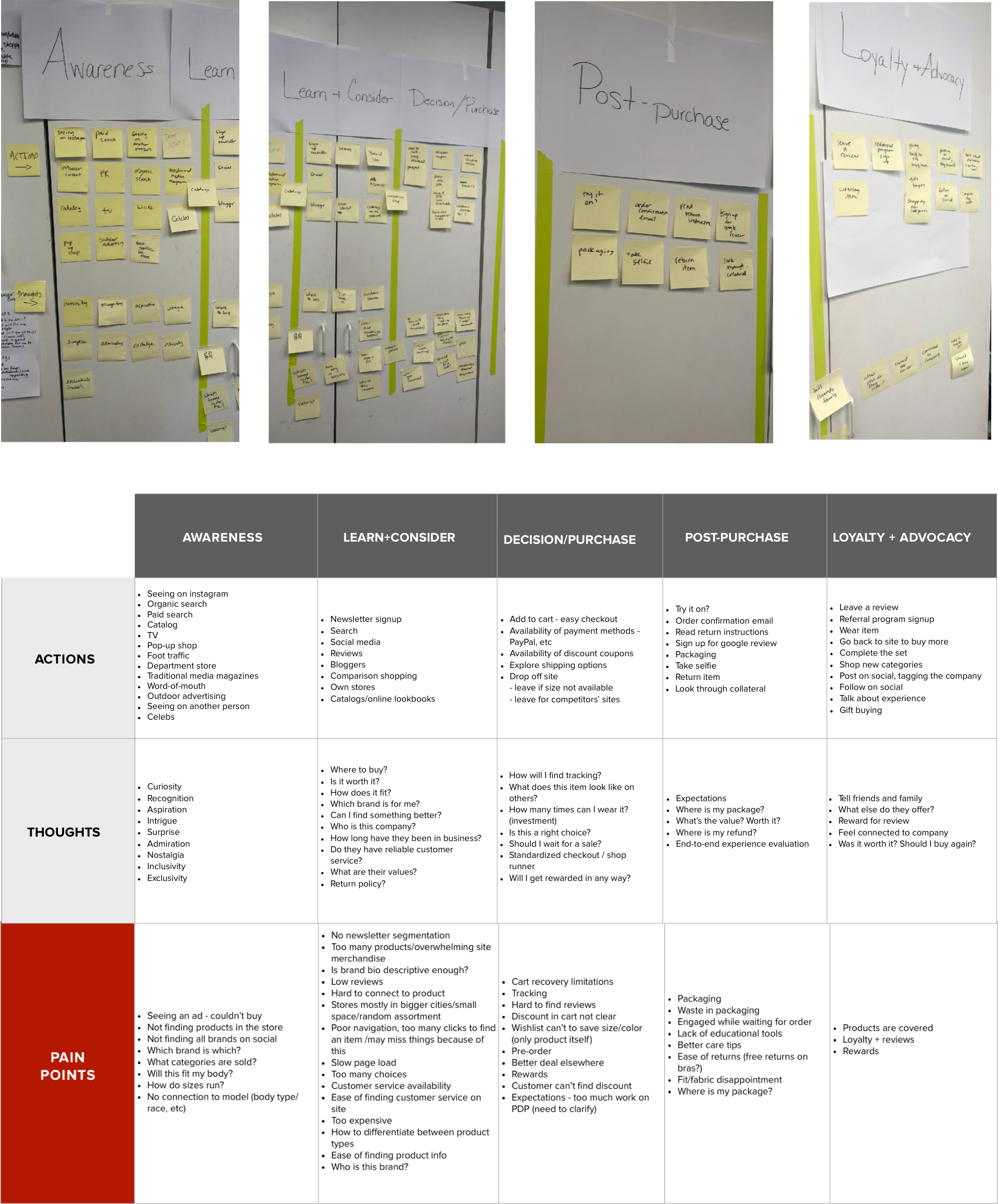

Discovery Workshop

To arrive at the shared understanding around what is being built, for whom, and the best way to build it, we kicked off the project with a co-creation discovery workshop.

Workshop goals

- Improve/re-imagine customer shopping experience, especially for younger demographic

- Clarify brand messaging, make each brand offering clear to the customers, find new and better ways to tell the brand story

- Re-think/simplify navigation structure

- Brainstorm ways to increase conversion

- Showcase depth and breadth of product catalog and content

- Refresh design and make it flexible/adaptable to suit strategy

Workshop Activities

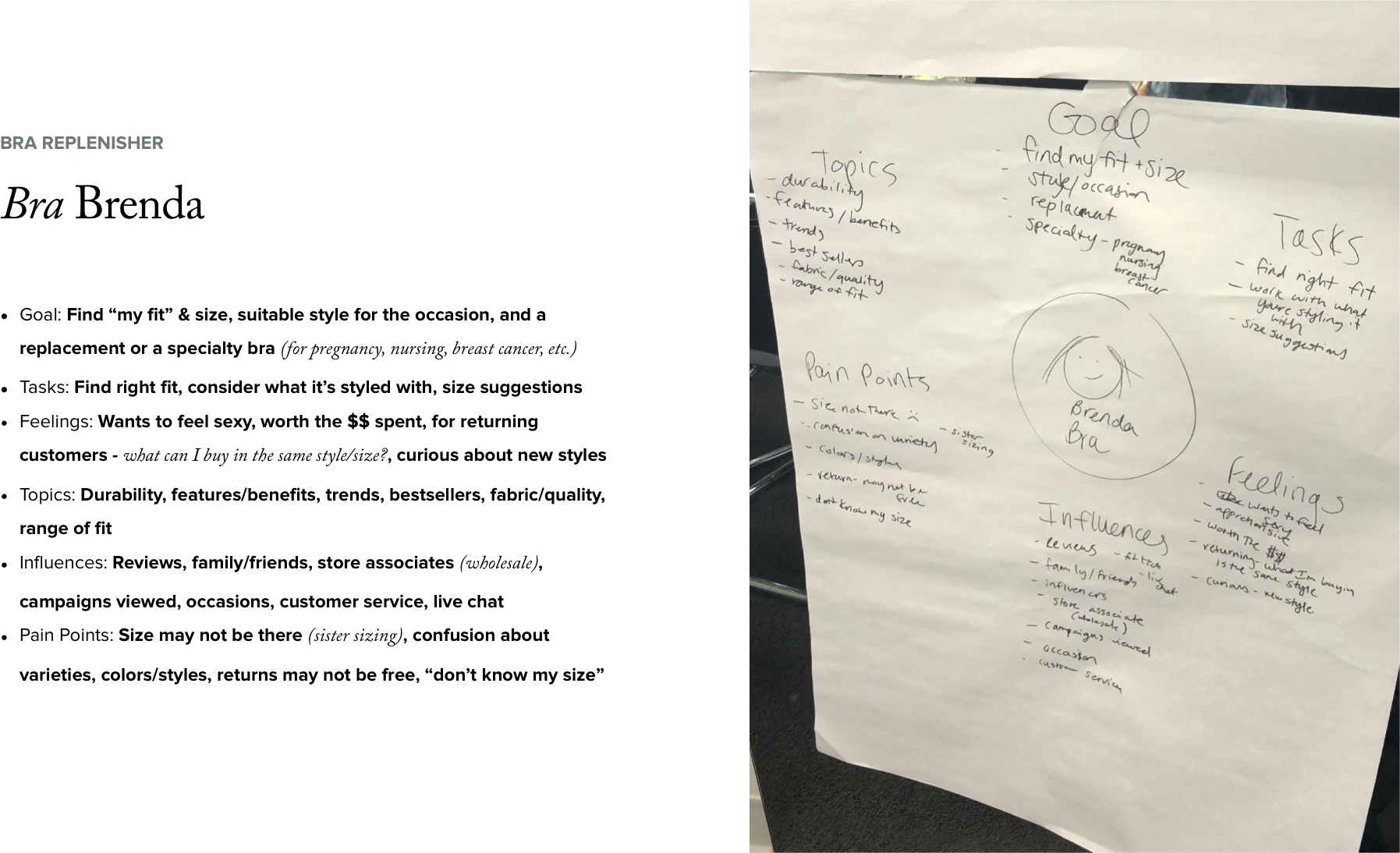

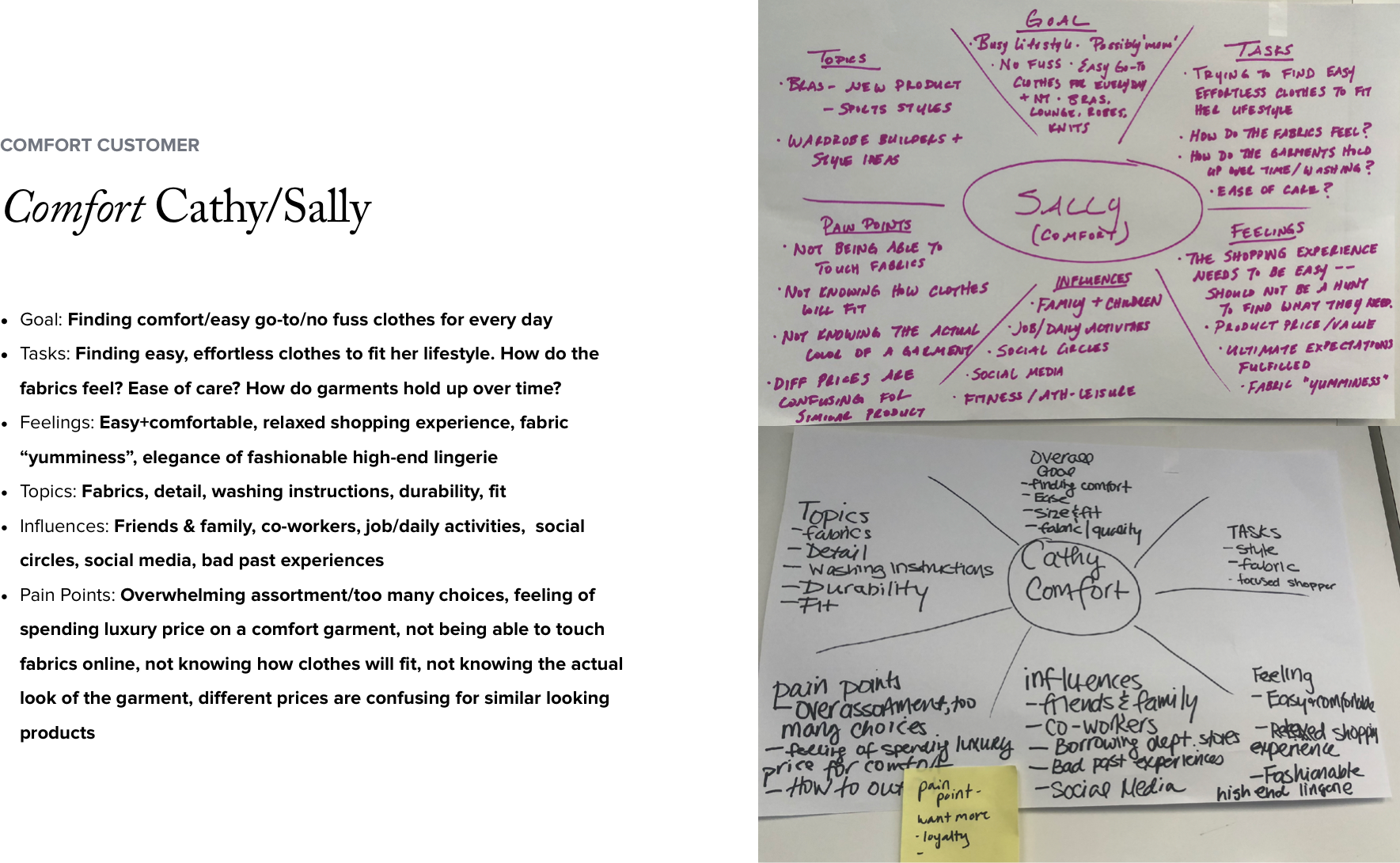

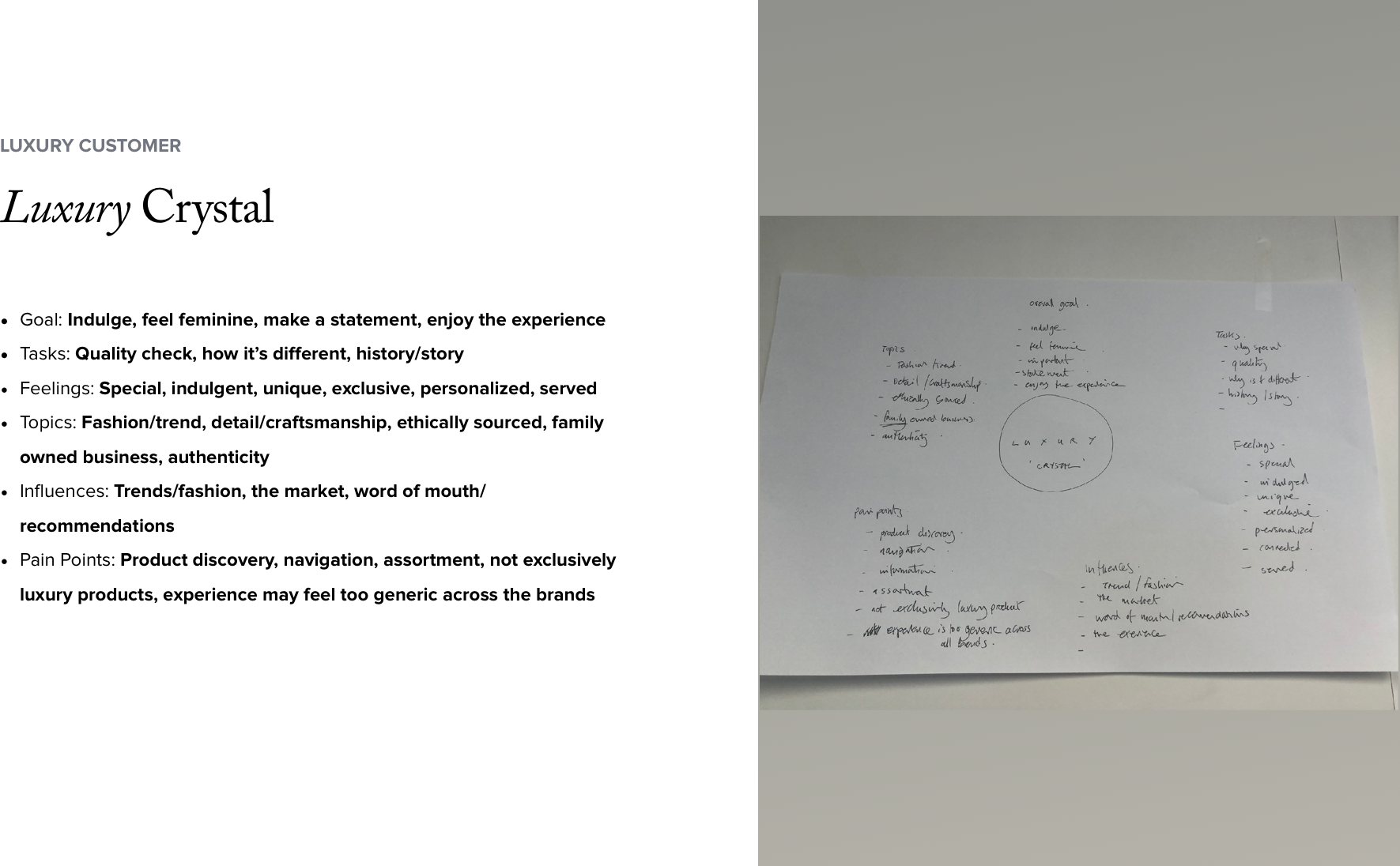

- Empathy Map / Personas: to understand the key customers.

- Customer Journey: to understand what key customers want to do, what actions they take, and their pain points.

- Brand Identity: to understand how ‘House of Natori’ and each of Natori brands (Josie Natori, Natori, Josie & N.Natori) desired be viewed by the customers.

- Navigation Structure / Taxonomy: to understand how product information should be categorized using card sorting exercise.

- Page Visualizations: to understand the necessary components/key functionality of elements & pages in the user journey for:

- Navigation

- Homepage

- Product Listing Page

- Product Detail Page

WORKSHOP INSIGHTS

Empathy Mapping & Proto-Personas

WORKSHOP INSIGHTS

Customer Journeys

Fashion shopper behaviors — and their outcomes — are evolving faster than ever before. “Always on” may be a cliché but in fashion, it’s as prevalent as ever. Fashionistas are consuming content 24/7 – and the brand needs to be there, measuring what works.

Customer Journey - Current

The fashion “journey” is chaotic. A fashion-driven consumer can join the journey at any point and leap straight to any other point of the journey.

With fashion, the consideration phase lasts forever.

And it feeds any point in the journey at any time. Impulse buys, buys that have taken months to save up for, buys influenced by friends, buys influenced by total strangers. All can happen in a heartbeat or over considerable time.

- All this tells us is that NATORI needs to have a presence at every point of the journey.

- Their advocates can change every moment of the day.

- Their campaigns can cause spontaneous purchase – If their assets reach the right person at the right time or in the right place.

- Loyalty is flaky, they need to be sure they can do everything in their power to capture positivity and see of negativity – how are they engaging with their acquired consumers?

- And with loyalty shifting so rapidly, they need to have a truly omni-channel presence to understand what their customers (and customers-to-be) are doing, how they’re behaving and what their current & future desires are likely to be.

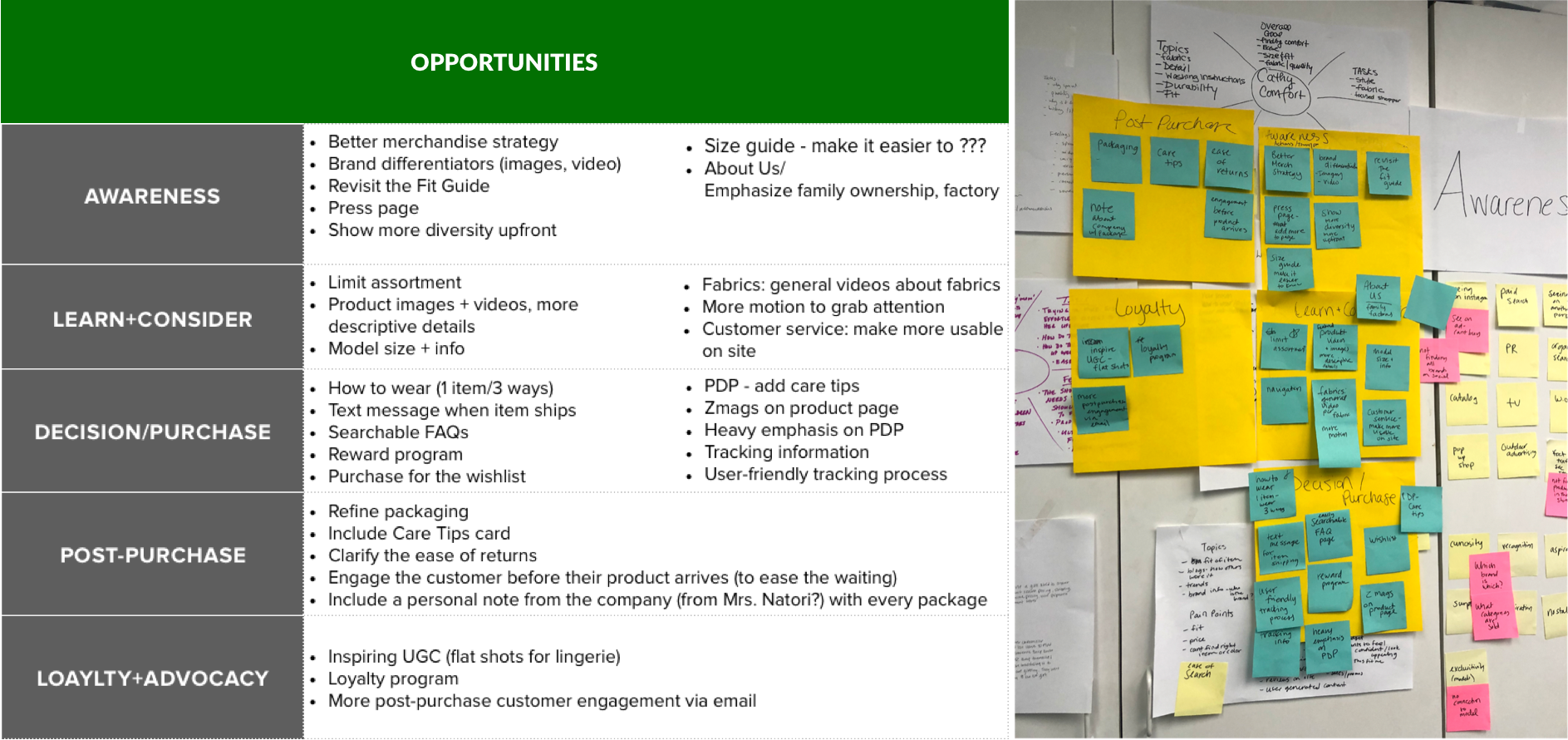

Customer Journey - Future State

Customer Insights: These days consumers expect frictionless shopping experiences with more transparency, interaction, and authenticity even from luxury brands. User-generated content fuels the shopping journey. A great mobile experience is an opportunity to stand out. Shoppers crave interaction before and after the transaction. Getting personal with shoppers can deliver a big payoff.

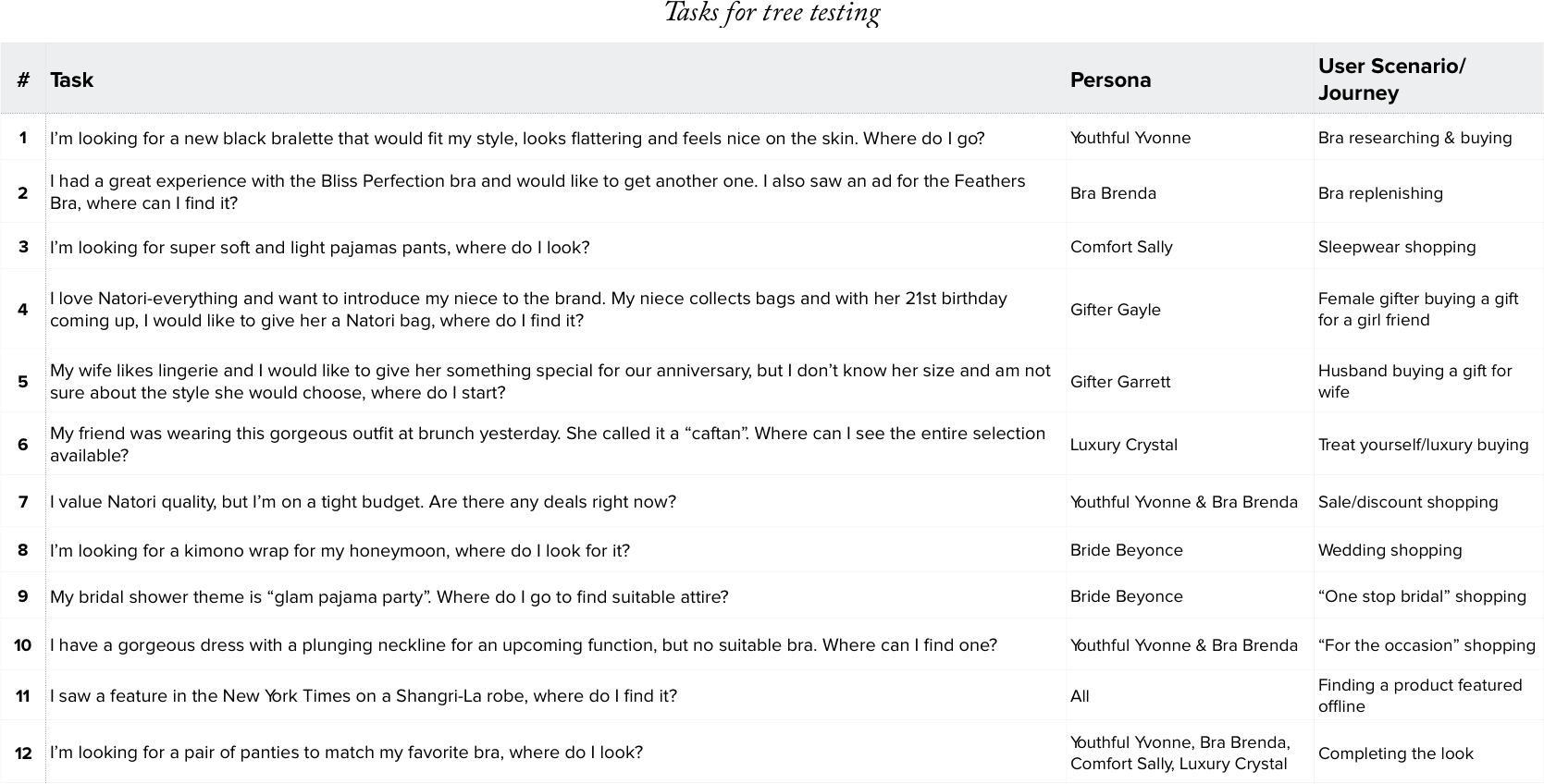

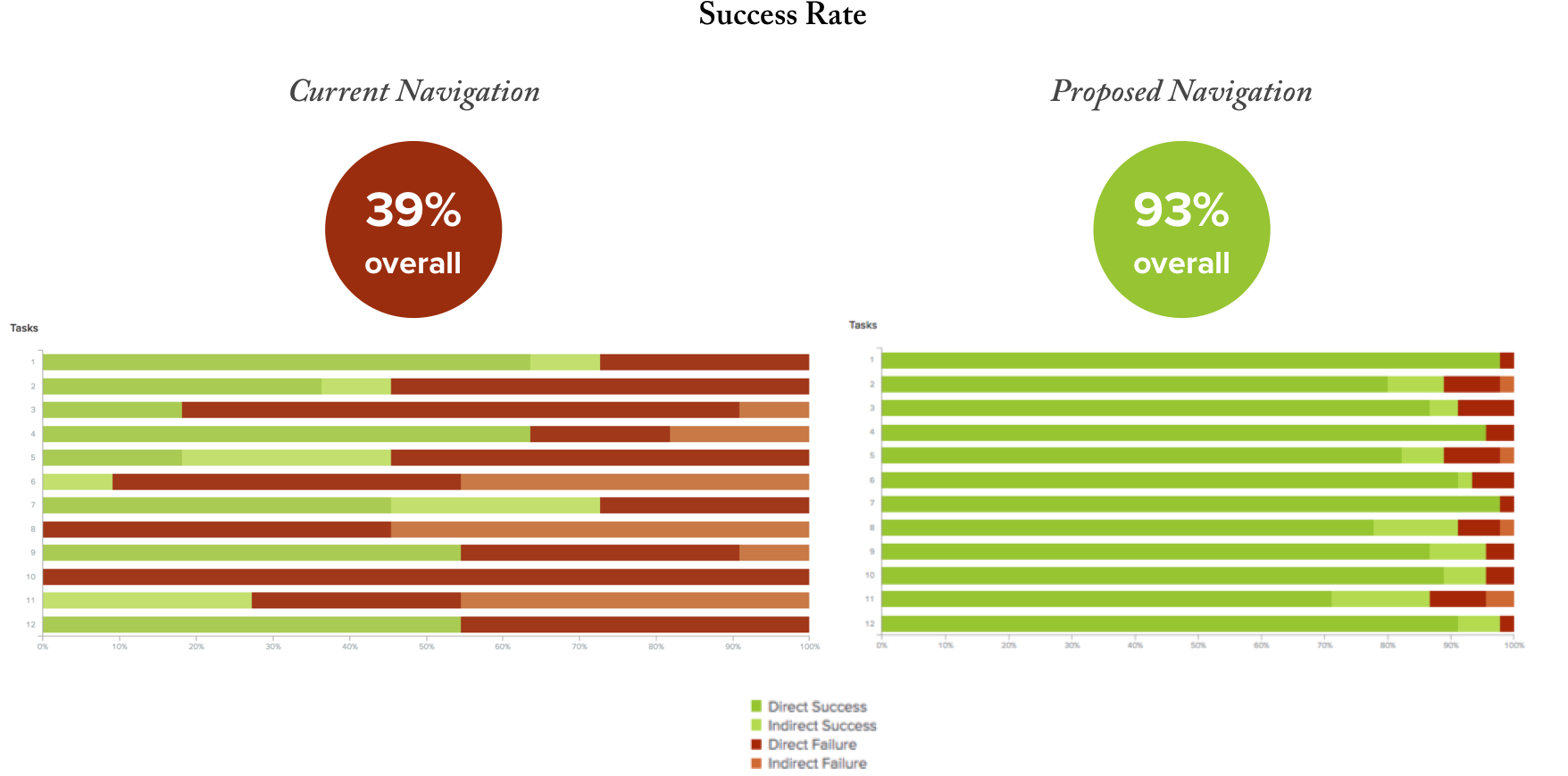

TREE TESTING

Evaluating Site Structure & Taxonomy

While Natori e-commerce site looked current and polished even before the redesign, it had a big underlying experience problem – the global navigation has been organized “by brand” , which for the new, brand-unaware customers was very confusing.

Original global navigation

Natori stakeholders were adamant that organizing products by brand was the only way not to alienate their loyal customers.

We proposed a little experiment – the original navigation vs. a revised one, where all products would be organized in categories based on their purpose, not the brand.

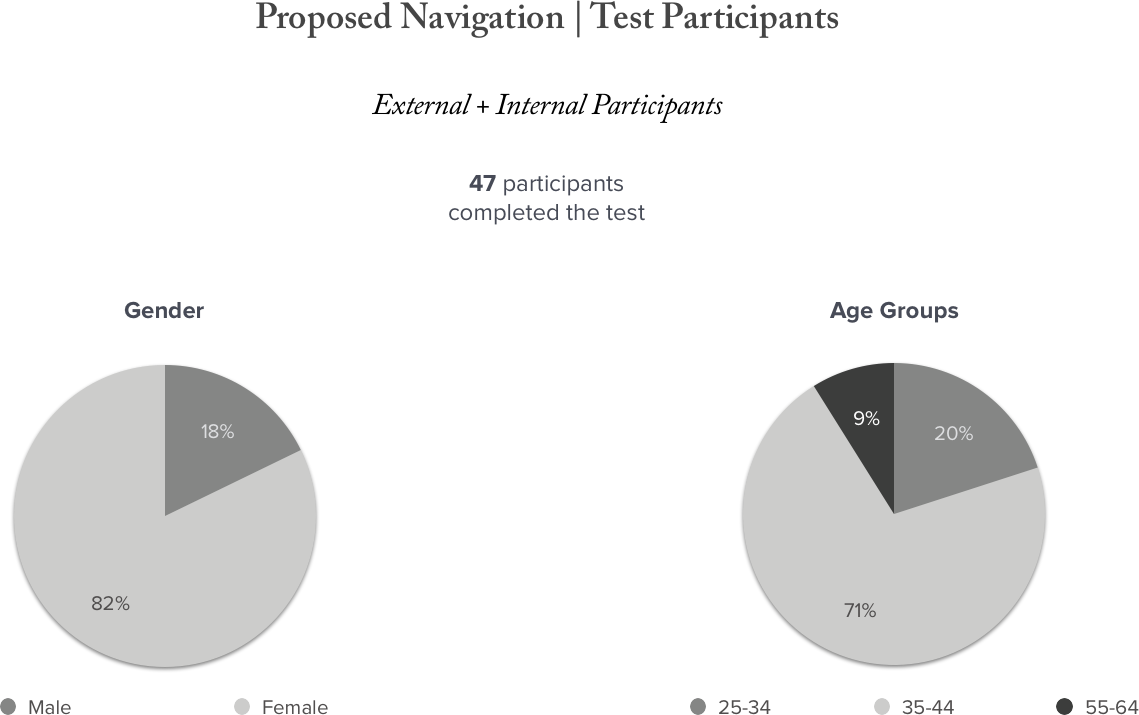

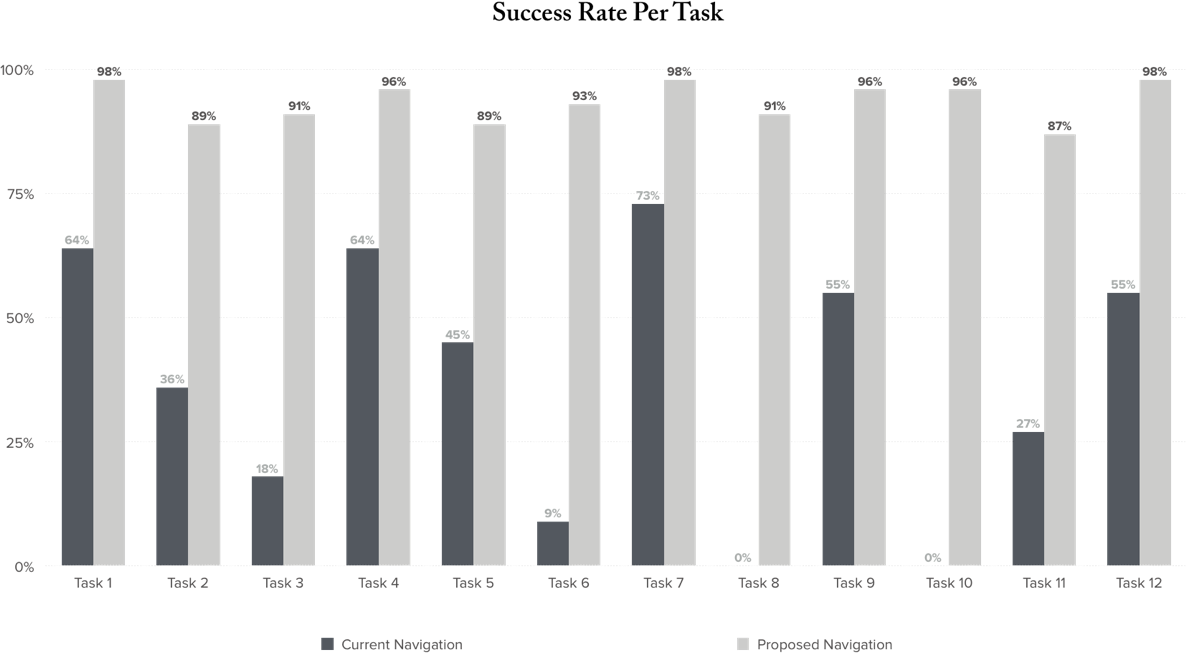

Of course, the common sense/best practices approach won the race among both brand unaware newbies and brand loyalists, and the results of the tree test are below.

TREE TEST SUMMARY

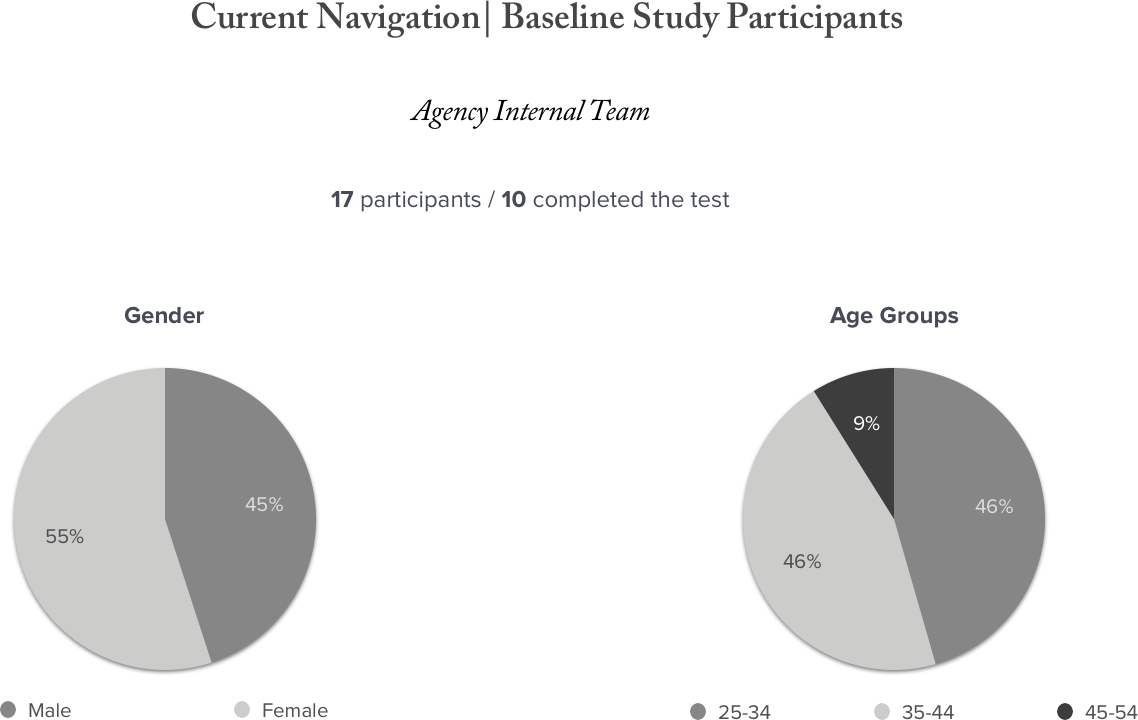

Current Navigation

Brand-unaware customers – most of the baseline test participants – 55% of whom qualified as a primary target demographic (female/25-34) – had very hard time locating answers and were confused by the identical product category names appearing under the different brand names.

Most comments received confirm participants’ state of confusion—

“these questions ALL rely on one knowing what the brands mean and stand for” (task #1)

“not intuitive” (task #2)

“Didn’t know the brands and just got lucky selecting the category Natori? “(task #3)

“Hard to know which ‘Natori’ brand I’m going for at the beginning.” (task #5)

“Not sure if this is the right place.” (task #5)

“Not sure where to look at all.” (task #6)

“Not very clear on where this would be found.” (task #8)

“I don’t know what the different brands denote.” (task #9)

Brand-unaware buyers are unable to find bestselling products such as Feathers bra (task #2) or Shangri-la robe (task #11) using the current navigation layout.

Bra buyers are unable to easily locate “special occasion” bras (task #10)

Bridal customers have low success rates finding bridal shower/wedding/honeymoon products (tasks #8 and 9)

Proposed Navigation

Both navigation trees (brand- and category-based) were tested with an identical set of tasks. Some tasks were intentionally phrased “vaguer” than others to evaluate customers browsing behavior and wayfinding approaches. Other tasks intentionally used product names (with the brand names removed) to analyze browsing patterns in the absence of search function.

Most comments received confirm that category-based approach is easier to navigate…

“super easy .. couldn’t be easier” (task #1)

“long list but I got there“(task #4)

“very intuitive” (task #10)

…we also received some categorization ideas & constructive criticism…

“Why is this nav not listed alphabetically” (task #4)

“without knowing how you categorize a caftan it was a little tricky” (task #6)

“would still need to know if convertible would work. There was also strapless that could have had the right bra. Also, I was wondering if accessories wouldn’t have pastie” (task #10)

With the switch to the product category-based navigation, overall success rate of task completion went from 39% to 93%.

Task by task success rates improved across the board, in most drastic cases from 0% to 96% (tasks #8 and 10).

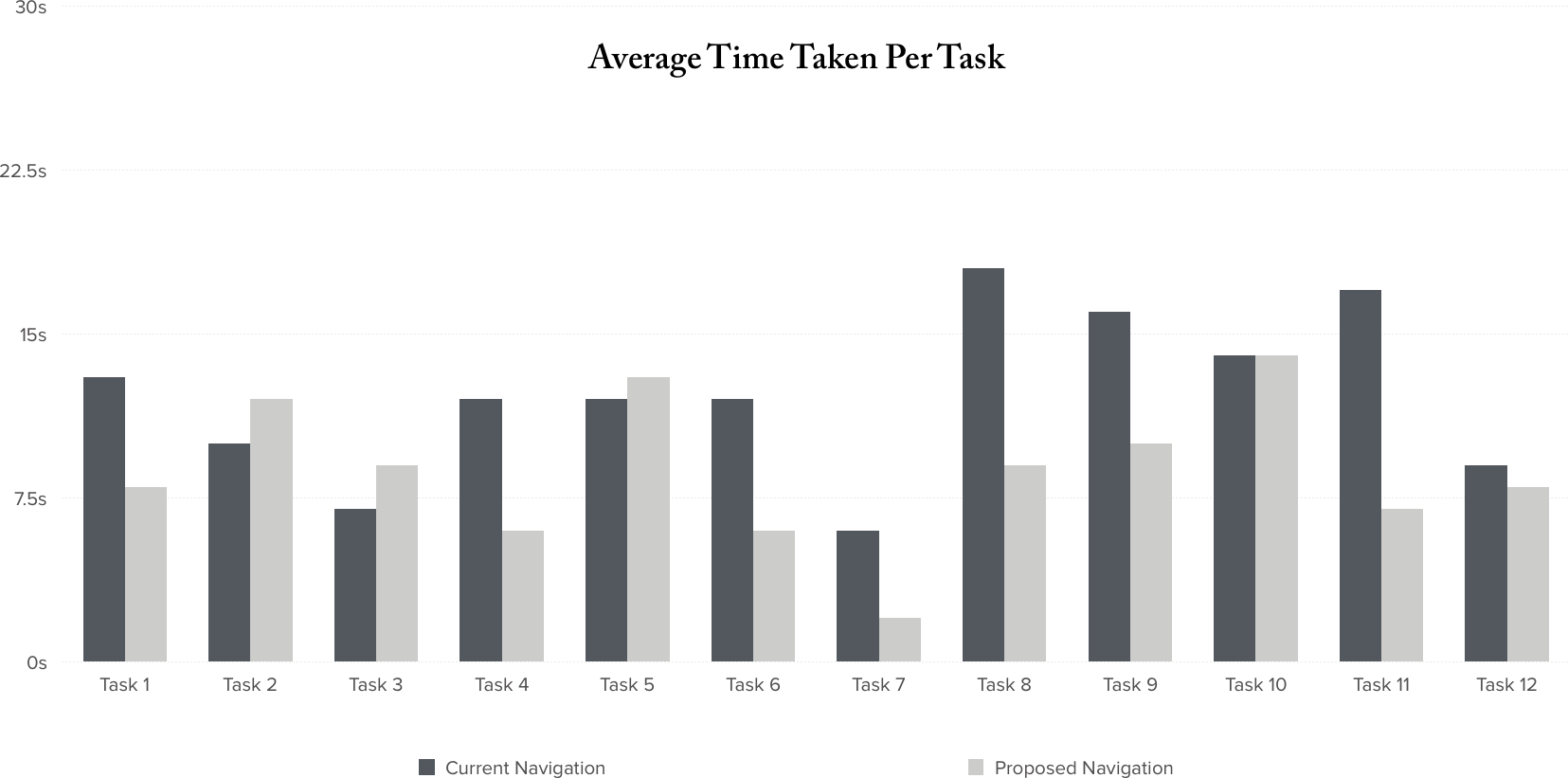

Average time per task went down on average by 35% to 45%.

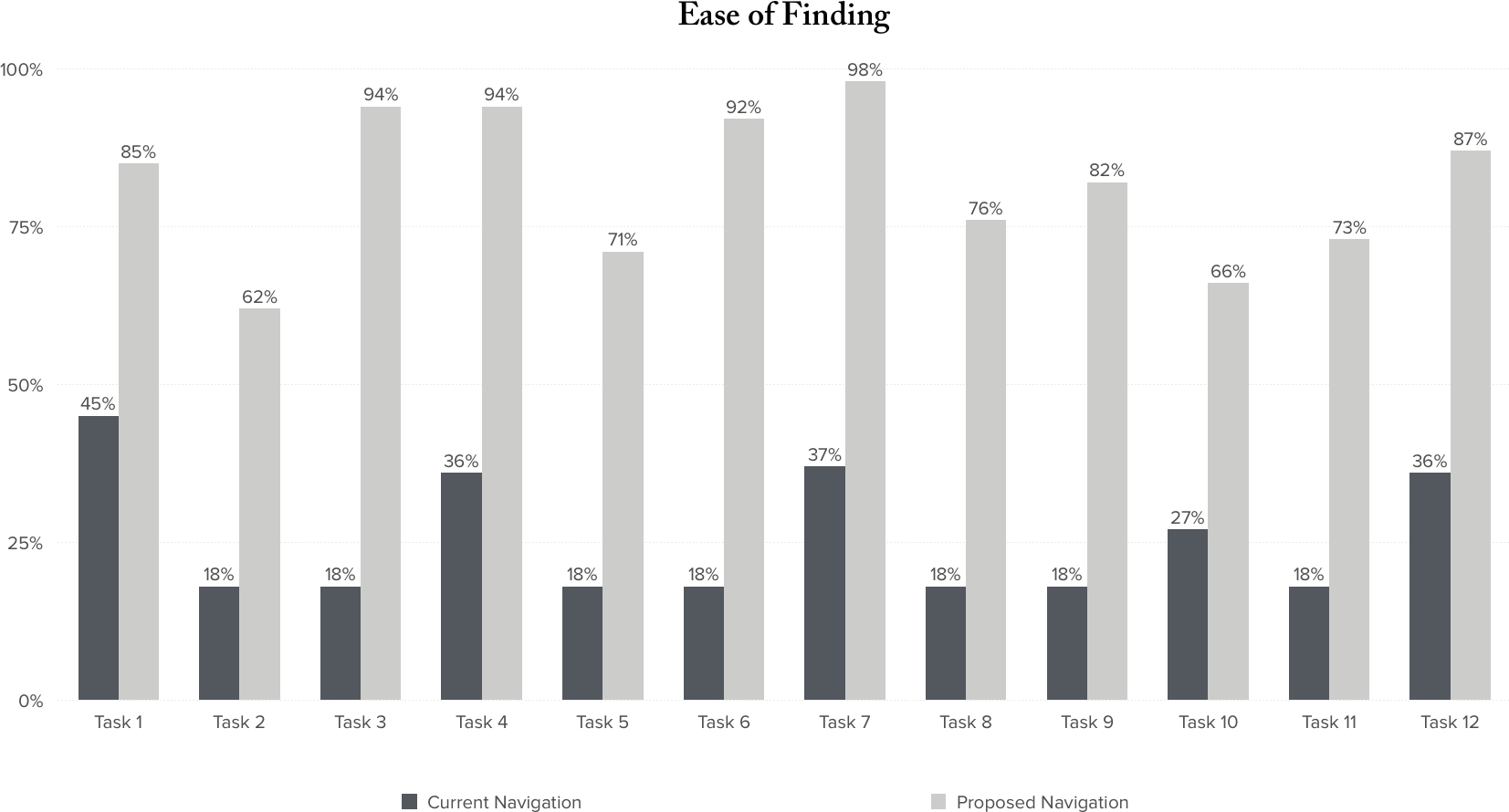

Ease of finding right answers tripled.

Tree Test Observations

- As the tree test confirmed, product category-based navigation is the way to go to simplify way finding for the new & brand-unaware customers.

- Some of the product categories/sub-categories – especially those with products that go home-to-office, day-to-evening or evening-to-sleep (ex. “caftans” or “robes”) – need to double be exposed in the navigation under “clothing” and “sleepwear” to attract maximum number of users.

- A relatively small number of brand loyalists still habitually rely on finding their favorite products through the brand-based navigation, which suggests that brands need to be represented in some capacity in the global navigation in order to provide brand loyalists with familiar way finding paths.

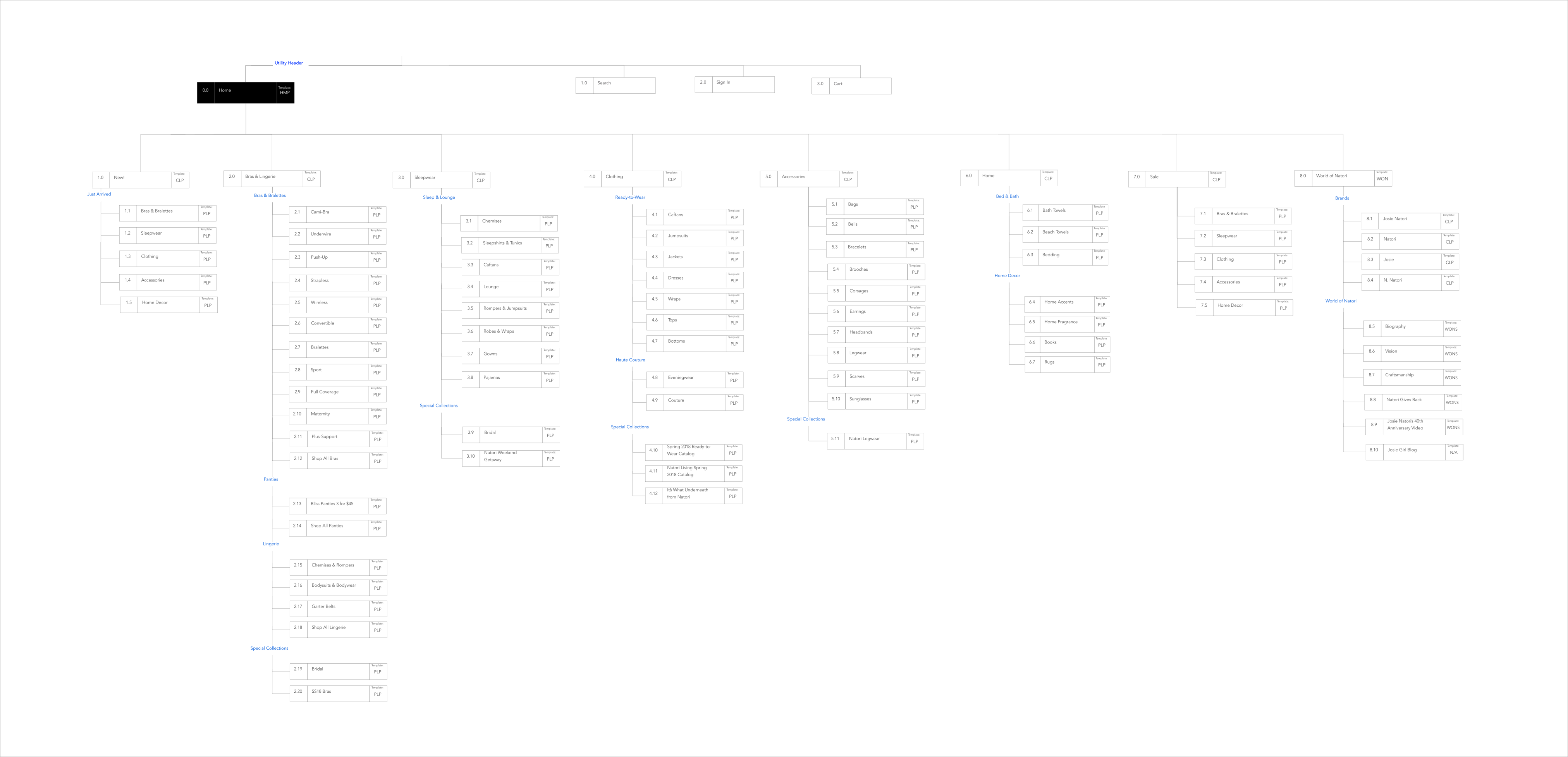

INFORMATION ARCHITECTURE

Sitemap

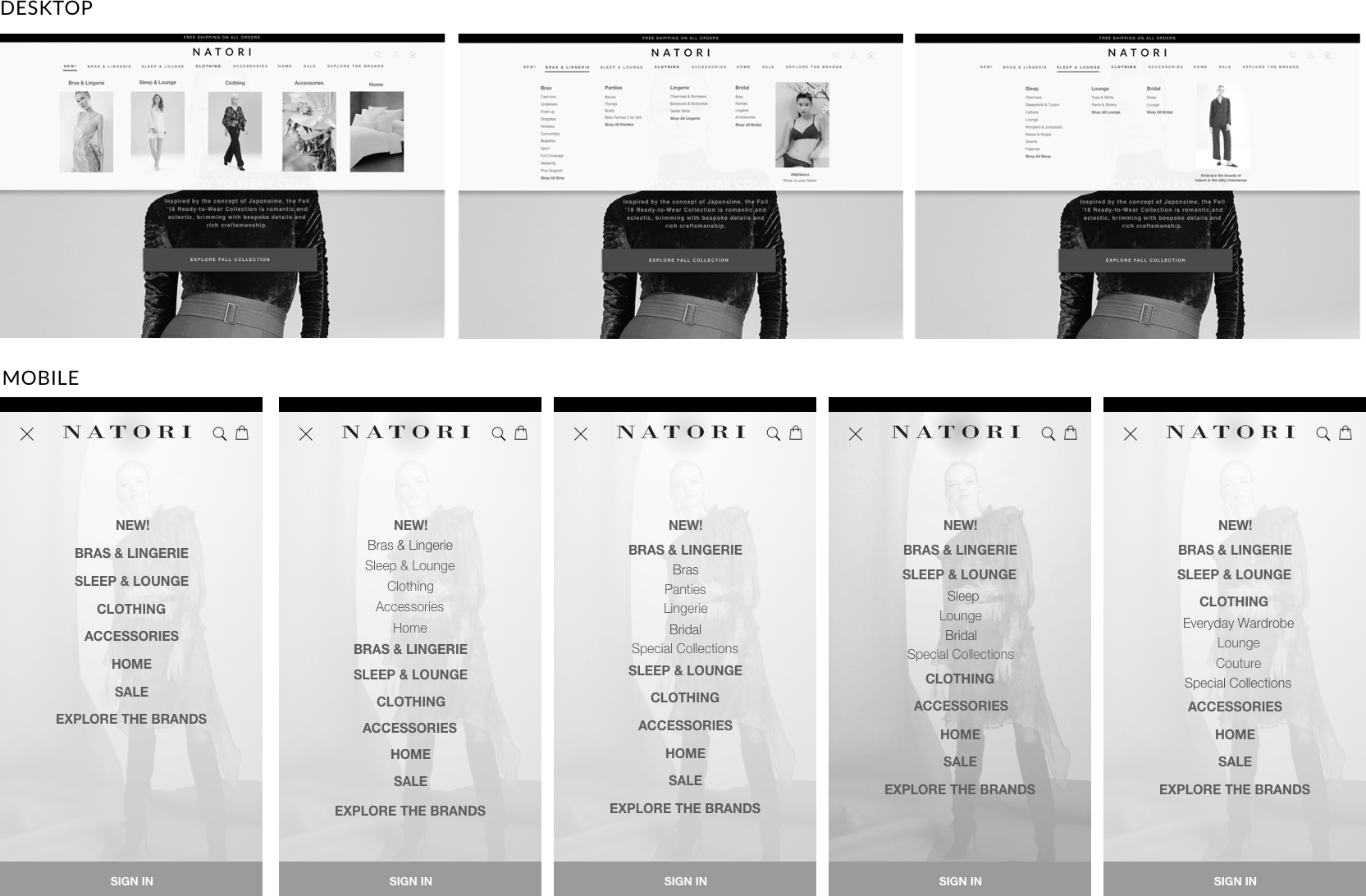

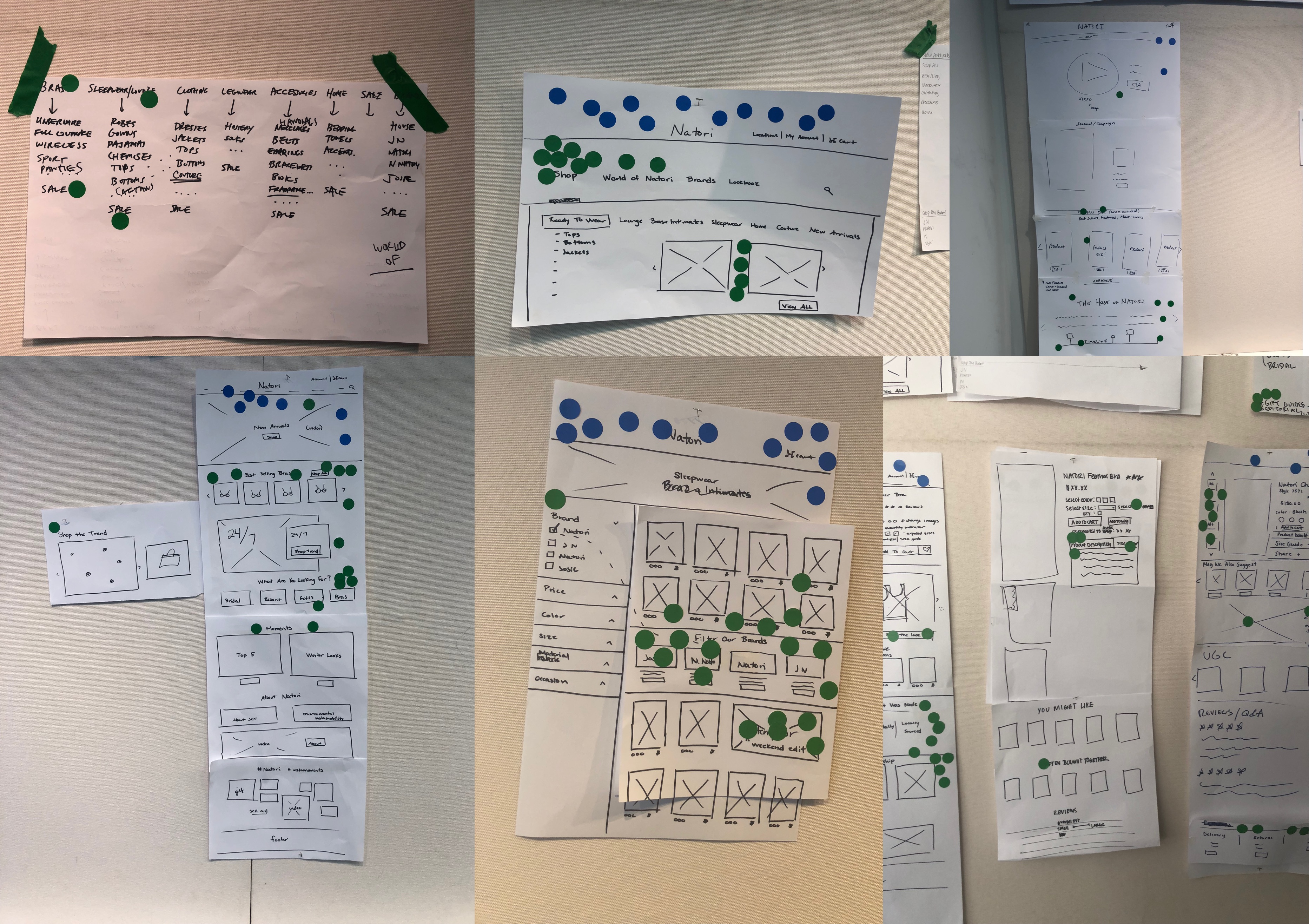

WIREFRAMING

Early Sketches

Results

+45%

Increase in conversion rate

-30%

Drop in bounce rate

The redesigned site was launched in the April of 2019 to the delight of the customers and stakeholders, and within the first weeks showed an unseen before increase in conversion rates.